Empowering the Next Generation A Comprehensive Look at Next Gen Personal Financ

Introduction:

In today’s complex financial landscape, the importance of financial literacy cannot be overstated. With the rise of digital transactions, investment options, and debt complexities, individuals face more financial decisions than ever before. However, navigating this terrain can be daunting, especially for young people entering adulthood. Enter Next Gen Personal Finance, a pioneering platform dedicated to equipping the next generation with the knowledge and skills necessary to navigate the intricacies of personal finance successfully.

The Imperative of Financial Literacy

In this section, we explore the fundamental importance of financial literacy in contemporary society. We discuss how sound financial knowledge empowers individuals to make informed decisions, manage debt effectively, and plan for their future financial security. Furthermore, we examine the societal implications of widespread financial illiteracy, such as increased debt burdens, reduced economic mobility, and disparities in wealth accumulation.

The Origins and Vision of Next Gen Personal Finance

Here, we delve into the inception and mission of Next Gen Personal Finance. Founded by educator Tim Ranzetta in 2009, the organization seeks to revolutionize financial education by providing comprehensive resources and support to educators. We explore Ranzetta’s vision of democratizing financial literacy and empowering students from all backgrounds to achieve financial independence.

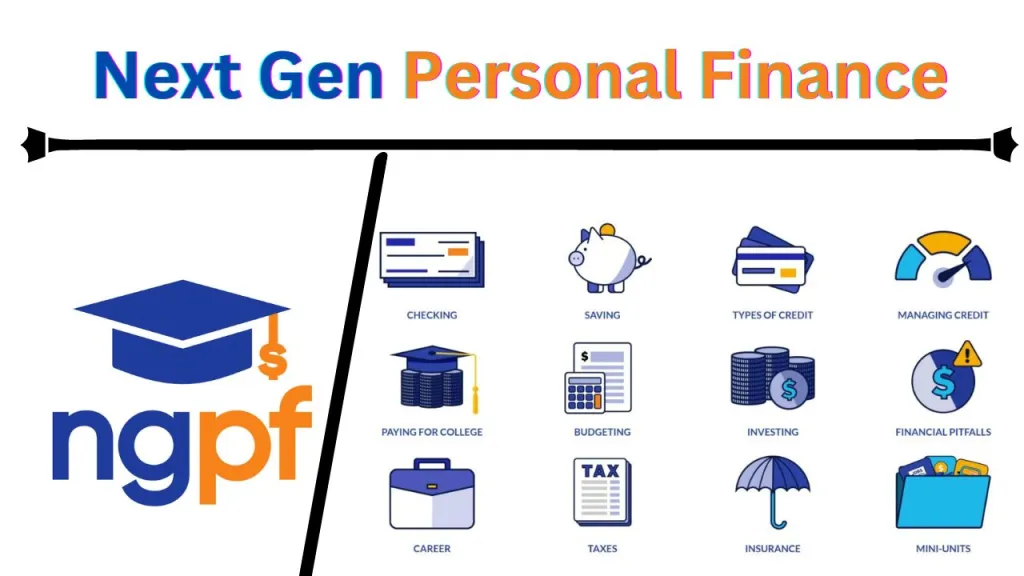

The Next Gen Personal Finance Curriculum

This section provides an in-depth analysis of the Next Gen Personal Finance curriculum. We examine the breadth and depth of topics covered, including budgeting, saving, investing, credit management, and retirement planning. Additionally, we highlight the interactive nature of the curriculum, which utilizes real-world examples and scenarios to engage students actively in the learning process.

Empowering Educators

In this segment, we explore the vital role of educators in delivering effective financial education. We discuss the professional development opportunities offered by Next Gen Personal Finance, such as workshops, webinars, and conferences, which enable educators to enhance their teaching skills and stay abreast of the latest trends in financial education. Furthermore, we examine the supportive online community fostered by the organization, which facilitates collaboration and resource sharing among educators nationwide.

Impact and Outreach

Here, we assess the impact of Next Gen Personal Finance on students, educators, and communities across the country. Through testimonials, case studies, and quantitative data, we demonstrate the transformative effects of the organization’s curriculum and resources on financial literacy levels, academic achievement, and long-term financial outcomes. Additionally, we examine the organization’s efforts to promote diversity, equity, and inclusion in financial education and address systemic barriers to access.

Future Directions and Challenges

This section explores the future directions and challenges facing Next Gen Personal Finance. We discuss potential avenues for expanding the organization’s reach and impact, such as partnerships with schools, districts, and policymakers. Additionally, we examine ongoing challenges, such as funding constraints, curriculum development, and adapting to evolving technological and economic trends.

Empowering Financial Futures: The Mission of Next Gen Personal Finance

In an era where financial decisions carry unprecedented weight in shaping our lives, the need for comprehensive financial education has never been more pressing. Recognizing this imperative, Next Gen Personal Finance has emerged as a trailblazer in the field, dedicated to equipping the next generation with the knowledge, skills, and confidence to navigate the complexities of personal finance successfully. Let’s delve into the mission, methodologies, and impact of this transformative organization.

Pioneering Financial Literacy

At the core of Next Gen Personal Finance‘s mission lies a commitment to democratizing financial literacy. Founded by educator Tim Ranzetta in 2009, the organization set out to address the glaring gaps in financial education prevalent in schools across the country. Armed with a vision of empowering students from all backgrounds to achieve financial independence, Next Gen Personal Finance embarked on a journey to revolutionize financial education through innovation, collaboration, and advocacy.

Comprehensive Curriculum for the Digital Age

Central to Next Gen Personal Finance’s approach is its comprehensive curriculum, designed to meet the evolving needs of today’s digital-native learners. Covering a wide array of topics, from budgeting and saving to investing and retirement planning, the curriculum provides educators with the tools and resources they need to deliver engaging and relevant financial education. By incorporating real-world examples, interactive activities, and multimedia content, Next Gen Personal Finance ensures that students are not only equipped with essential financial knowledge but also empowered to apply it in practical scenarios.

Empowering Educators for Success

Recognizing the pivotal role of educators in shaping students’ financial futures, Next Gen Personal Finance places a strong emphasis on professional development. Through workshops, webinars, and conferences, educators gain access to best practices, pedagogical strategies, and curriculum insights to enhance their teaching effectiveness. Furthermore, the organization fosters a vibrant online community where educators can collaborate, share resources, and seek support from peers across the nation. By empowering educators with the knowledge and tools they need, Next Gen Personal Finance catalyzes a ripple effect of positive change in classrooms and communities nationwide.

Measurable Impact, Transformative Outcomes

The impact of Next Gen Personal Finance extends far beyond the confines of the classroom, with measurable outcomes that underscore its effectiveness. Through rigorous evaluation and assessment, the organization has demonstrated significant improvements in students’ financial literacy levels, academic performance, and long-term financial behaviors. Moreover, testimonials from students and educators alike attest to the transformative power of Next Gen Personal Finance in empowering individuals to make informed financial decisions and achieve their financial goals.

Championing Diversity, Equity, and Inclusion

In its pursuit of financial literacy for all, Next Gen Personal Finance is unwavering in its commitment to championing diversity, equity, and inclusion. Recognizing the systemic barriers that disproportionately impact marginalized communities, the organization actively seeks to address inequities in access to financial education. By promoting culturally responsive pedagogy, advocating for equitable funding, and amplifying diverse voices in the financial education space, Next Gen Personal Finance strives to create a more inclusive and equitable financial future for all.

Conclusion:

In conclusion, Next Gen Personal Finance stands as a beacon of hope in the quest for financial literacy and empowering. By providing educators with the tools and resources they need to deliver high-quality financial education, the organization is helping to build a more financially literate and resilient society. As we look to the future, let us continue to support and champion the efforts of Next Gen Personal Finance in equipping the next generation with the knowledge and skills they need to thrive in an increasingly complex and interconnected world.

For More Information Please Visit These Websites Craiyon And Arturia