S&P 500: A Beginner’s Guide to America’s Stock Market Pulse

Table of Contents

Want to understand the U.S. economy’s heartbeat? Dive into the S&P 500, track 500 top companies, and learn about potential benefits and risks before making any investment decisions.

What is the S&P 500?

The S&P 500 is a stock market index that tracks the performance of the largest publicly traded companies in the United States. It’s often seen as a benchmark for the overall health of the U.S. economy.

Here are some key things to know about the S&P 500:

- It’s made up of big companies: Think tech giants like Apple and Alphabet, household names like Amazon and Berkshire Hathaway, and leaders in industries from healthcare to finance.

- It’s a good indicator of the economy: When the goes up, it usually means the economy is doing well. When it goes down, it can signal potential trouble ahead.

- It’s a popular investment: Many people invest in the through mutual funds or exchange-traded funds (ETFs) because it’s a way to get exposure to a broad range of successful companies.

Why is the S&P 500 so important?

It’s a bellwether: Its ups and downs are often seen as a reflection of the overall health of the U.S. economy. A rising suggests a thriving economy, while a falling one can signal potential trouble ahead.

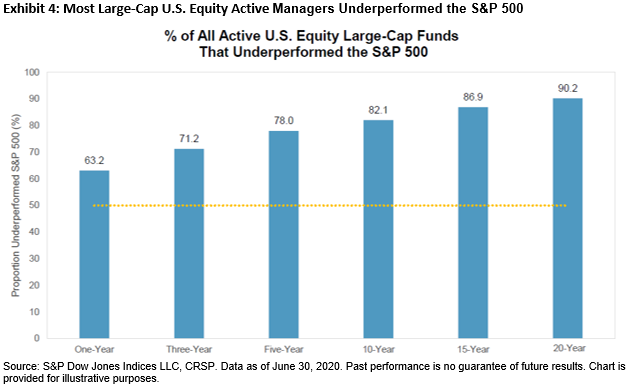

It’s a benchmark: Investors a yardstick to measure the performance of their portfolios. If their investments are outperforming the index, they’re doing well!

It’s accessible: Want a piece of the American dream? You don’t need millions to invest in the S&P 500. Mutual funds and exchange-traded funds (ETFs) allow you to track the index’s performance with a single investment.

Reasons Why the S&P 500 is a Good Place to Invest Your Money

The be a valuable tool for understanding the US stock market, but it’s important to remember that investing involves risk and there’s no guarantee of success. Here are some aspects of the to consider:

Potential benefits:

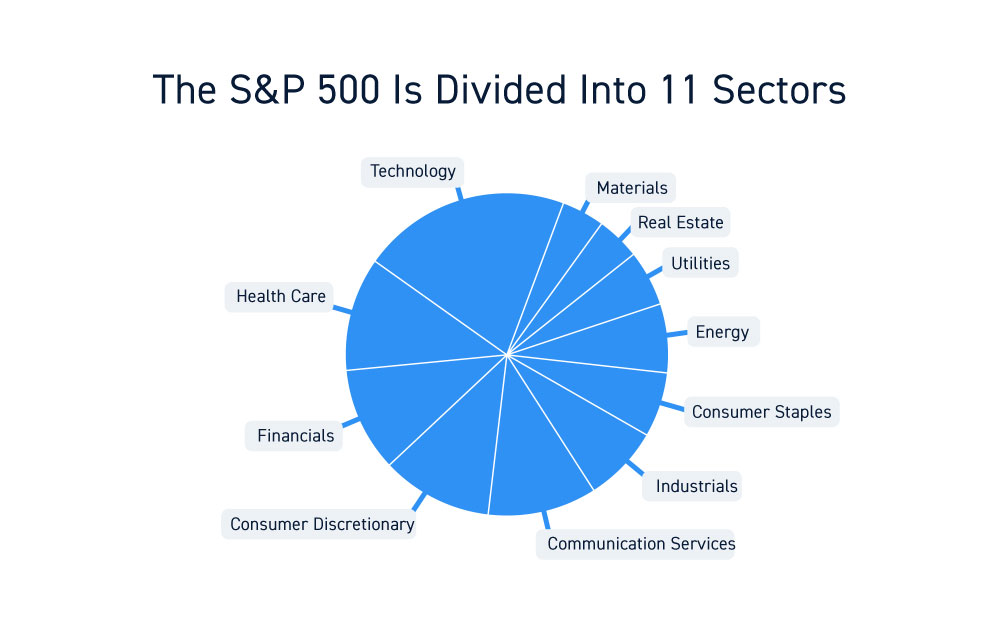

- Diversification: It tracks large companies across various sectors, which can help spread out risk compared to individual stocks.

- Long-term performance: Historically, the S&P has provided average annual returns of around 10% over long periods (like 20+ years). However, past performance is not a guarantee of future results.

- Relatively low cost: You can invest in the through index funds or ETFs with low fees.

Is it Suitable to invest in the S&P 500?

As you’re under 18, investment decisions should be made in consultation with a responsible adult, such as a parent, guardian, or a qualified financial advisor. They can help you understand your unique circumstances and options.

Here are 10 important points to consider when evaluating which will also be valuable for understanding investments in general:

1. Diversification: The S&P 500 tracks large companies across various sectors, offering a spread of risk compared to single stocks. However, remember there are other ways to achieve diversification.

2. Long-term potential: Historically, the S&P 500 has shown positive returns over long periods (like 20+ years). However, past performance is not a guarantee of future results.

3. Relative cost: Investing in the through index funds or ETFs can be quite affordable. Still, compare fees and consider other low-cost investment options.

4. Liquidity: You can easily buy and sell shares of S&P 500 index funds, making them liquid investments. But remember, any investment can experience unexpected changes in value.

5. Transparency: Companies in the meet specific criteria, increasing transparency compared to many individual stocks. But even reputable companies can face challenges.

6. Risk of loss: The S&P 500 can experience significant short-term losses, and there’s always a chance of losing money over any given period.

7. Time horizon: Consider your long-term goals and risk tolerance. The might not be suitable for short-term needs or low-risk tolerance.

8. Alternative investments: Explore various investment options beyond, each with its risks and potential returns. Understanding them empowers you to choose wisely later.

9. Financial literacy: Building a strong foundation in financial knowledge now will prepare you for informed investment decisions later, regardless of specific choices.

10. Professional guidance: Consulting a qualified financial advisor can help you assess your circumstances and develop a personalized financial plan, including suitable investment options.

Remember, investment decisions should be based on your specific needs and goals. It’s always good to research, understand the risks, and seek professional guidance before investing.

Final Thoughts

The S&P 500 tracks big US companies like Apple and Amazon. It’s like a thermometer for the economy: up means good times, down means potential trouble.

Investing in it can offer benefits like diversification and long-term returns, but also carries risks.

As you’re under 18, talk to a trusted adult or financial advisor about whether it’s suitable for you. They can help you understand your options and make informed decisions.

For More Information Please Visit These Websites Craiyon And Arturia