Unlocking Financial Wisdom A Guide to the Best Personal Finance Books

Table of Contents

Introduction:

In a world where financial literacy is increasingly crucial for success, the power of books to impart valuable knowledge and insights cannot be underestimated. Personal finance books offer a wealth of wisdom, providing readers with practical advice, strategies, and tools to manage their money effectively, build wealth, and achieve financial independence. In this article, we explore some of the best personal finance books available, offering readers a roadmap to financial empowerment and success.

The Importance of Financial Education

In this section, we discuss the significance of financial education in today’s society. We explore how a solid foundation in personal finance equips individuals with the knowledge and skills to make informed decisions, navigate economic challenges, and secure their financial future. Additionally, we examine the consequences of financial illiteracy, such as debt, financial insecurity, and missed opportunities for wealth accumulation.

Criteria for Selecting the Best Personal Finance Books

Here, we outline the criteria used to evaluate and select the best personal finance books. We discuss factors such as author credibility, content relevance, readability, and practical applicability. By establishing clear criteria, readers can confidently choose books that align with their goals, interests, and learning preferences.

Top Personal Finance Books for Building Wealth

This section highlights some of the best personal finance books focused on wealth-building strategies. We provide detailed summaries and insights into each book, including key takeaways, actionable advice, and real-life examples. From budgeting and saving to investing and entrepreneurship, these books offer invaluable guidance for readers seeking to grow their wealth and achieve financial freedom.

Essential Personal Finance Books for Financial Planning

In this segment, we feature essential personal finance books that focus on financial planning and management. We explore topics such as retirement planning, tax optimization, estate planning, and risk management. By providing readers with comprehensive strategies and frameworks, these books empower individuals to create customized financial plans that align with their long-term goals and aspirations.

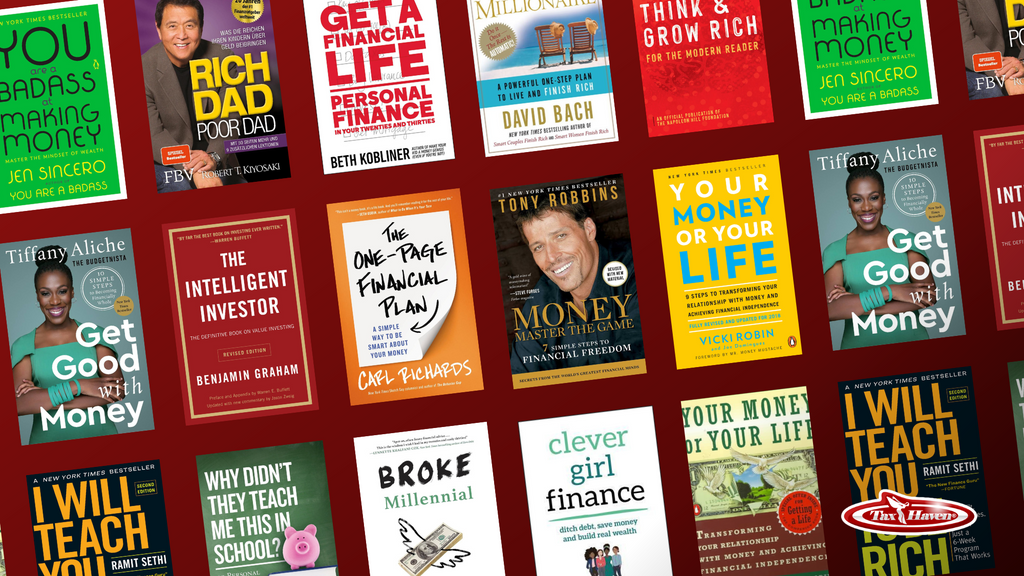

Unlocking Financial Wisdom: Exploring the Top Personal Finance Books

In the vast landscape of personal finance literature, navigating through the plethora of options can be overwhelming. However, certain books have emerged as timeless classics, offering invaluable insights and practical advice for managing money, building wealth, and achieving financial independence. Let’s explore some of the best personal finance books available, each a beacon of financial wisdom in its own right.

The Millionaire Next Door” by Thomas J. Stanley and William D. Danko

First published in 1996, “The Millionaire Next Door” is a groundbreaking exploration of the habits and characteristics of America’s wealthy individuals. Through extensive research and interviews, the authors debunk common myths about wealth and reveal the surprising truths behind millionaire status. With its emphasis on frugality, discipline, and long-term planning, this book offers readers a roadmap to financial success grounded in practicality and perseverance.

Rich Dad Poor Dad” by Robert T. Kiyosaki

A perennial bestseller since its publication in 1997, “Rich Dad Poor Dad” challenges conventional notions of wealth and success. Drawing from the author’s own experiences and insights from his “rich dad” and “poor dad,” Kiyosaki explores the importance of financial education, asset accumulation, and passive income generation. With its straightforward narrative and actionable advice, this book inspires readers to rethink their approach to money and pursue financial independence on their own terms.

The Total Money Makeover” by Dave Ramsey

Renowned financial expert Dave Ramsey provides a step-by-step guide to financial freedom in “The Total Money Makeover.” Through his proven principles of budgeting, debt elimination, and wealth building, Ramsey empowers With its practical strategies and motivational tone, this book serves as a powerful tool for individuals seeking to break free from debt, build wealth, and live with financial peace.

Your Money or Your Life” by Vicki Robin and Joe Dominguez

Originally published in 1992 and updated for the modern era, “Your Money or Your Life” offers a holistic approach to personal finance and life fulfillment. The book challenges readers to reassess their relationship with money and prioritize their values and passions over material possessions. Through its nine-step program for financial independence, Robin and Dominguez guide readers on a journey towards greater financial awareness, simplicity, and purpose.

The Intelligent Investor” by Benjamin Graham

Considered a timeless classic in the world of investing, “The Intelligent Investor” by Benjamin Graham provides invaluable insights into the principles of value investing. First published in 1949 and revised by Jason Zweig, this book offers timeless wisdom on topics such as risk management, market psychology, and the importance of a margin of safety. With its emphasis on discipline, patience, and rationality, “The Intelligent Investor” remains essential reading for investors of all levels.

Must-Read Personal Finance Books for Financial Independence

Here, we showcase must-read personal finance books that emphasize the principles of financial independence and early retirement. Drawing from the FIRE (Financial Independence, Retire Early) movement, these books offer unconventional approaches to achieving financial freedom, such as frugality, minimalism, and passive income generation. By challenging traditional notions of work and retirement, these books inspire readers to design lifestyles that prioritize financial independence and fulfillment.

Conclusion:

In conclusion, personal finance books serve as invaluable resources for empowering individuals with the knowledge, skills, and confidence to achieve financial success. By offering practical advice, actionable strategies, and real-world insights, these books demystify complex financial concepts and empower readers to take control of their financial futures. As readers embark on their journey to financial literacy and independence, may they find inspiration and guidance in the pages of these transformative books.

For More Information Please Visit These Websites Craiyon And Arturia